Photo by Vitaly Taranov on Unsplash

It can sometimes seem impossible for low-income households to get ahead in today’s economy. Financial pressures can have a debilitating impact on your life. Too many families are familiar with the pattern of purchasing only the bare necessities, putting off replacing broken appliances, and spending all their time commuting to and from jobs that pay too little and ask too much. The economic hamster wheel leaves little opportunity for saving, or to enjoy your daily existence. The following are a few creative, yet simple ideas to help you get a handle on your financial stress and get back to loving life.

Wiggle Room

Unfortunately, lower-income families can find it nigh impossible to access credit with mainstream lenders. Locked out of the market, many turn to high-interest options such as payday loans for a lifeline that ends up being a deadweight around their necks. Fortunately, a growing number of government agencies and not for profits are offering interest-free loans for people on low incomes, to spend on necessities, like home appliances, or car insurance. Sometimes that wiggle room is all you need to ease yourself of some of that stress.

Master Chef

The ease of ordering takeaway in our modern society means a lot of money can quickly disappear on food. Yet it’s cheaper and healthier to cook your meals at home. All you need to do is change your perspective on meals preparation. Instead of a chore, transform it into a fun-filled activity. Numerous celebrity chefs that have a wealth of cheap, easy recipes that turn into delicious meals. So, get a quick recipe online, put on some music, and turn it into a joyful ritual. Get your family involved, and make preparing the meal just as enjoyable the meal itself.

Saving Grace

It’s hard to think that a small amount of money set aside every day can make a significant difference in the long run. However, with a bit of discipline and patience, you will be amazed at how much it can add up to over time. Even as little as 50 cents a day, or 10 dollars a week squirreled away into a dedicated savings account you don’t regularly check, your long-term savings can really start to grow. If you can’t get yourself into the habit of putting the money aside, there are apps that can do it for you, all at a rate you’re comfortable with.

Free Entertainment

Just because the budget is tight doesn’t mean you have to skimp out on cultural activities. You can spend hours wandering around free museums, markets, and historic buildings. Your local backyard is someone else’s tourist daydream. Check out the tourism travel page for your local city and see what they recommend is a must do for free. There are always plenty of ways to entertain the family without having to fork out hundreds.

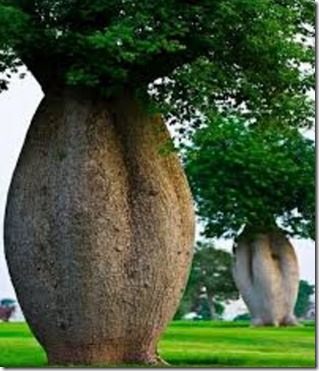

Au Naturale

Whatever the weather, whether you feel like lazing around or getting active nature has you covered. Plan a trip to the beach, and spend the day lazing on the sand. Alternatively, plan a trip to the hills and go for a hike. Getting out of your four walls and enjoying nature has many mental health benefits, and it doesn’t cost a cent. Even if you end up doing precisely what you were planning on doing inside, such as relaxing with a book, or tapping away on your computer, if you do it outside, you’ll feel much better for it.

Having money problems doesn’t have to take the joy out of life. Cheap activities are still fun activities, and clearing your head of stress can help set you up for a financially stable future.