No one gets money for free, but the refund from Commonwealth bank, Westpac bank, ANZ and National Australia Bank might be hitting your bank account soon.

Forget EOFY tax return refunds from the tax office, this is sweeter as you don’t have to apply for it, its your money getting refunded without any paperwork needed.

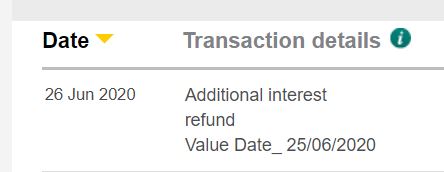

If you see this in your commonwealth bank account

Additional interest

refund

Value Date_ 25/06/2020

The refund posting may look different depending on which bank you bank with.

Fancy a $10,000 refund?

Refunds can be anywhere from couple of thousand dollars to even $10,000 or more depending on how many loans you have with the bank.

Why the refund ?

If you have a refund looking like above in your bank account you could have possibly got a refund related to remediation done on your home loan, refunding you amounts of interest that was wrongly charged by the bank.

This is due to the remediation the banks have been forced to do due to the government enquiry into banks and how they treat and charge their customers.

CBA Refund on home loan interest charges 2020 for COVID19

This is not a refund, but more like a payment for the interest on interest you get charged for your deferred home loan repayments. Australia’s largest bank will make payments to home loan customers impacted by coronavirus to offset interest charges.

When a home loan repayment is deferred for six months, interest is calculated and added to the loan balance each month which can result in customers paying interest on interest each month. Anyone having a home loan could possibly get this refund before end of June this year.

“This means for an average loan of $350,000, CBA will be refunding approximately $45 to offset the effect of interest on interest over the six-month period. Customer payments will vary based on their loan amount and interest rate.” Commonwealth bank representative said.

2020 – Big four’s Banks current relief packages for covid19

The four major banks in March announced they would allow home loan customers to defer mortgage repayments for six months as part of a $100 billion scheme with the Reserve Bank of Australia to alleviate stress on Australian households, as thousands are tipped into unemployment.

CBA – Following the end of the six-month pause, home loan repayments remain the same as before, with the loan term being extended. CBA will also make a one-time payment to offset the interest on interest being charged to customers over the deferral.

Westpac – Impacted customers are being offered a 3-month pause with the option for a further 3 months after review. Home loan repayments increase after the deferral, but the loan term remains the same.

NAB – Following the repayment holiday, home loan repayments increase, but the loan term remains the same.

ANZ – Customers can choose to keep the loan term the same or extend it by six months, with a review at three months, with both options likely resulting in mortgage repayments increasing after the pause.

Robodebt refund: June 2020

The Federal Government has announced it will refund more than $721 million dollars in wrongly issued Centrelink debts to over 373,000 Australians.

The incorrect debt collections made between the 2015/2016 financial year and November 2019 targeted individuals who had supposedly received more welfare than their income entitled them to.

The debts were automatically calculated by special algorithms without human intervention and became known as rob debts.

How do I get my robo debt refund?

If your eligible, the amount will get credited in your account, so update your details on mygov if not done already. Government Services Minister Stuart Robert said 190,000 individuals will be repaid starting from July 1.

Royal Banking Commission Australia

Started: 14 December 2017

Ended: 4 February 2019

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, also known as the Banking Royal Commission and the Hayne Royal Commission, was a royal commission established on 14 December 2017 by the Australian government pursuant to the Royal Commissions Act 1902 to inquire into and report on misconduct in the banking, superannuation, and financial services industry.

2018 CBA Junk Insurance Refund

After the royal commission, refunds for 140,000 were said to be issued to CBA customers

Commonwealth Bank will issue $16 million in refunds to 140,000 people who were sold add-on insurance right before the bank’s ‘junk’ products become the subject of royal commission hearings.

“Consumer credit insurance” has been pitched to customers as a safety net that’ll help them meet their credit card or loan repayments if they lose their job, become sick, injured or die. The financial regulator characterises them as not of much value and consumer groups simply describe them as ‘junk’.

Consumer Credit Insurance. Consumer credit insurance (CCI) covers you if something happens to you that affects your ability to meet your credit repayment. You may be offered CCI cover by your lender when it approves your credit (such as a credit card, personal loan or mortgage).

Find more about this here- https://www.choice.com.au/money/insurance/insurance-advice/articles/commonwealth-bank-refund-16m-junk-insurance-royal-commission-080318

2016 -Recent Fee for no service scandal:

The sweeping scandals – tagged by ASIC as “fees for no service” in its landmark report in October 2016 – saw the big banks and AMP targeted for practices dating back years where millions of dollars in fees were creamed off accounts for financial advice never given.

Wealth management and financial advice industries were involved and investigated in the banking royal commission for this scandal.

Commonwealth bank Wealth package refund in 2015

This happened in 2015. If you held a wealth package, you could have got a refund. The Commonwealth Bank of Australia (CBA) was said to refund approximately $80 million to around 216,000 Wealth Package customers as compensation for failing to apply fee waivers, interest concessions and other benefits since 2008.

It equated to an average refund per customer affected of around $370, which includes interest. In this case bank staff had to manually apply many of the discounts available under the Wealth Package, which in some instances did not occur.

2017 – CommInsure refunding – CCP premiums

Commonwealth Bank and insurers QBE and Virginia Surety would repay a total of over $26 million to people who were mis-sold add-on insurance, including consumer credit insurance.

CreditCard Plus (CCP) Insurance protects customers’ credit card repayment obligations in the event of death, terminal illness, disability and involuntary unemployment.

Following a review of their records, they identified that CCP Insurance may have been sold to a number of customers who may not have been eligible for all the benefits when they bought their policy. Therefore, they were refunding the premiums paid by impacted customers.

More details here – https://www.commbank.com.au/insurance/creditcard-plus/faqs.html

2020 Westpac refund for small business – Merchant terminal fee relief

The Merchant terminal fee relief was a part of Westpac’s COVID-19 support package for Australian businesses, for 3 months, starting in April 2020.

All eligible merchant customers would have received their final refund payment and westpac are working to provide you with a GST adjustment note for tax purposes in the coming weeks.

Who is eligible? -Merchant customers with a total card spend of less than $5 million per annum.

More here- https://www.westpac.com.au/help/disaster-relief/coronavirus/business/merchant-terminal-fee-refunds/

2015 – 2019 Nab Refunds

NAB’s refund program was set up in 2015, however only about $300 million has been paid back to customers. IN 2015 National Australia Bank WAS SAID TOl refund A$25 million ($18.38 million) to around 62,000 wealth management clients who were wrongly compensated.

In 2019 Nab was ordered to pay back money to customers for junk insurance given to customers by shoddy financial advice. This came about by the royal banking commission.

It now expects another of its remediation Project Hunt to be finished in October.

ASIC is currently overseeing more than 100 remediation programs expected to pay out more than $2 billion to consumers on top of the almost $1 billion that has already been returned. About $10 billion has been set aside by the industry for remediation programs.

Qantas refund /Airline refund/ Flight Centre Travel agent refund

Qantas and Singapore airlines have many destination flights from Australia and there are thousands of customers still waiting for refunds directly from the airlines or then from flight centre or travel agents.

Airlines have given a mix of “travel credit” “travel vouchers” flights for future and money refunds. Flight centre has attracted court action and being looked into by authorities for delay in them giving refunds to customers.

Those customers who have accepted a travel credit voucher may not be eligible for a refund of money, however those whose flights got cancelled will be able to claim a refund.

Delayed air ticket and hotel accommodation refunds by travel agents and airlines could lead to further legal action being taken by irate customers due to interest charges escalating on credit cards.

Qantas Refunds

https://www.qantas.com/us/en/book-a-trip/flights/compensation-and-refunds-policy.html

Singapore Airline refund

https://www.singaporeair.com/en_UK/us/travel-info/charges-changes/cancellations-refunds/

Flight Centre Refunds

https://www.flightcentre.com.au/support/bookings#my-options

https://www.accc.gov.au/media-release/flight-centre-to-refund-cancellation-fees

The ACCC has received more than 6000 complaints from consumers dissatisfied with travel companies’ refund policies and cancellation fees, with thousands more contacting their local state or territory fair trading agencies seeking assistance resolving individual disputes.

Qantas is refunding customers for flight cancellations after the ACCC COVID-19 Taskforce raised concerns with the way the airline had handled claims

CRUISE REFUNDS

COVID-19 has been called one of the worst things to happen to the cruise industry in decades.

Thousands of cruise customers from big cruise companies like Caribbean Cruise, Princess Cruise, Carnival Cruises and P & O Cruises are awaiting their refunds due to cancellation of cruises all over the world.

Most cruise liners though American owned, operate from overseas tax haven countries and so has been denied by USA for financial bailouts in the COVID19 Crisis times.

Most cruise liners are offering cruise credits to their customers leaving not many options to disgruntled clients.

Princess cruises

https://www.princess.com/news/notices_and_advisories/notices/refunds-and-future-cruise-credits.html

Royal Carribean Cruises

https://www.royalcaribbean.com/faq/questions/booking-cancellation-refund-policy

P&O cruises

https://www.pocruises.com/request

Carnival Cruises

https://help.carnival.com/app/answers/list/search/suggested/1

Reference Websites

Banks:

Westpac Bank – https://www.westpac.com.au/

ANZ Bank – https://www.anz.com.au/

National Australia Bank – https://www.nab.com.au/

Commonwealth Bank – https://www.commbank.com.au/

Government:

ASIC – https://asic.gov.au/

ATO – https://www.ato.gov.au/

APRA – https://www.apra.gov.au/

ACCC – https://www.accc.gov.au/

Search Keywords to Article:

Refund from CommBank 2020

Commonwealth bank refund

Credit in bank account

When do I get my cruise refund