What do you do when an emergency occurs that you have to attend to, and the payday hasn’t arrived? Now is the time to explore the options that allow you to send money online, especially those that accept funding from a credit card.

Using A Credit Card

A credit card is an excellent way to buy goods and pay for services when you have no money. Similarly, you can use your credit card to transfer funds to your friends, family, or businesses across the globe. However, it would help if you shop right for the service provider, so you don’t pay hefty charges.

Similarly, several money transfer services allow you to transfer funds across the globe, but not all accept credit card funding. That means you may need to find out which one will take your funding method. Some of the options you have include bank wire transfer, PayPal, Remitly, or Western Union.

Challenges of Using a Credit Card

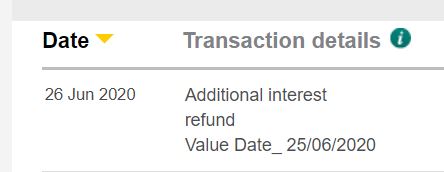

Using a credit card may be too costly, depending on the service you’re using. Bank wire transfer, for example, often costs higher than the other methods. Even though most services may be fair, currency exchange may still be a stumbling block since the rates change almost daily. Similarly, some transfer services also charge a high interest rate from the day of transfer.

However, you may find a fairer choice by shopping for the right provider.

Things To Look Out For While Sending Money Internationally With A Credit Card

Using a credit card to fund international transfers is typically costly compared to debit cards or your bank balance. However, some situations necessitate the need to use a credit card for your transfer. If that’s the case, consider these factors to get fairer costs.

1. Consider Service Providers That Specifically Focus on International Transfers

Services that exclusively offer international transfers often provide better exchange rates and fairer transaction fees compared to banks.

Similarly, most of the transfer apps offer additional advantages, including the ability to track your transfer status. This service may be available whether you’re transacting to a bank account, mobile wallet, or cash pickup location.

Even so, remember that funding your transfer from your credit card account still comes at a fee from the card issuer.

2. Review The Fees and Exchange Rates

Some companies apply higher transaction fees and exchange rates on international transfers, regardless of whether you’re using a debit or credit card. Before you settle on the service provider, review charges from a few options, understand their fees and the fine print so you don’t fall prey to high costs.

When To Use A Credit Card on International Transfers

Funding your international money transfer using a credit card may not be the best option considering the high costs involved. However, it can be the right way to go through your transfers if:

• You have a financial emergency to attend to, but you have no other means of funding

• You earn royalties from reward programs such as frequent flyer miles or cash back.

A credit transfer may be convenient but is a bit costly. As a result, it’s best to treat it as the last resort if you don’t stand to gain any benefit from the transaction.